Automated trading

Traders are increasingly using automated trading, whereby the trader defines rules by which a trading platform automatically trades on their behalf.

Because of this, as part of their new mobile trading platform, a brokerage wanted to explore possible ways of integrating automated trading.

How could we empower users to become better traders through automation?

Automated trading

Background

- The brokerage previously supported third-party trading software platforms but now wanted to create their own mobile app to innovate and differentiate themselves.

- I was in a team of several UX designers - my solution would need to adapt and fit into what was being designed by others. A design system was being collaboratively developed which facilitated prototyping.

- Automated trading is an emerging tool becoming increasingly popular amongst (particularly experienced) traders

- Inclusion of any aspect of automated trading as a feature could therefore potentially provide a competitive advantage and increase trading volume through the brokerages’ platform

- The project timeframe was 4 weeks.

Process

During the 4-week timeframe, the following steps were taken:

- Desk research including survey data, and talking to sales and support staff

- Performed competitor analysis on existing implementations of automated trading on the market

- Interviewed SMEs and stakeholders to better understand the use for automated trading, good third-party implementations and where they fit into the user’s workflow

- Mapped out user journeys and flows

- Iteratively prototyped possible solutions

- Tested and refined prototypes with SMEs and other designers

Research

For this project I did some desk research into interest in automated trading and existing automated trading tools and techniques.

My desk research included looking into pre-existing survey data. From survey data I found:

- Data showed 30% of trades placed using some kind of automated strategy

- A lot of interest in automated trading, but not as much uptake

I found there were a number of existing tools and techniques that provide some or all parts of automated trading including:

- Expert advisors

- Backtesting

- Copy-trading

- Signals

- Screeners

I spoke to several SMEs and stakeholders inside the company, including people from sales and support and those with trading experience and knowledge. They raised some key issues:

- Scaling: automated trading allows traders to scale their trading strategy and trade 24/7 across more markets

- Risk: with scaling comes massively increased risk - both losses and wins can be magnified

- Strategy: a lot of traders don’t necessarily have a trading strategy, making it hard for them to automate. Professional traders will have a well-defined strategy.

- Micro-management: traders often like to micromanage their trades; they want to be in control

- Testing: testing the strategy over time and refining is critical

- Emotion: automation takes emotion out of the equation, allowing more rational trading behaviour

Ultimately, automated trading allows traders to:

- Scale their trading “system” to operate 24/7, across more markets without manual effort

- Take emotion out of the equation

However:

- There are massive risks to both the trader and the business of full automated trading, as both losses and gains are scaled. Inexperienced traders would incur massive losses, and the business could potentially be on the hook for losses incurred using their system.

- Traditionally automated trading has required programming ability, which limits its growth

Competitor analysis showed:

- Most existing automated trading tools had a steep learning curve and complex interface

- The more successful tools greatly reduce the learning curve by having conversational interfaces where you build an automation from simple building blocks

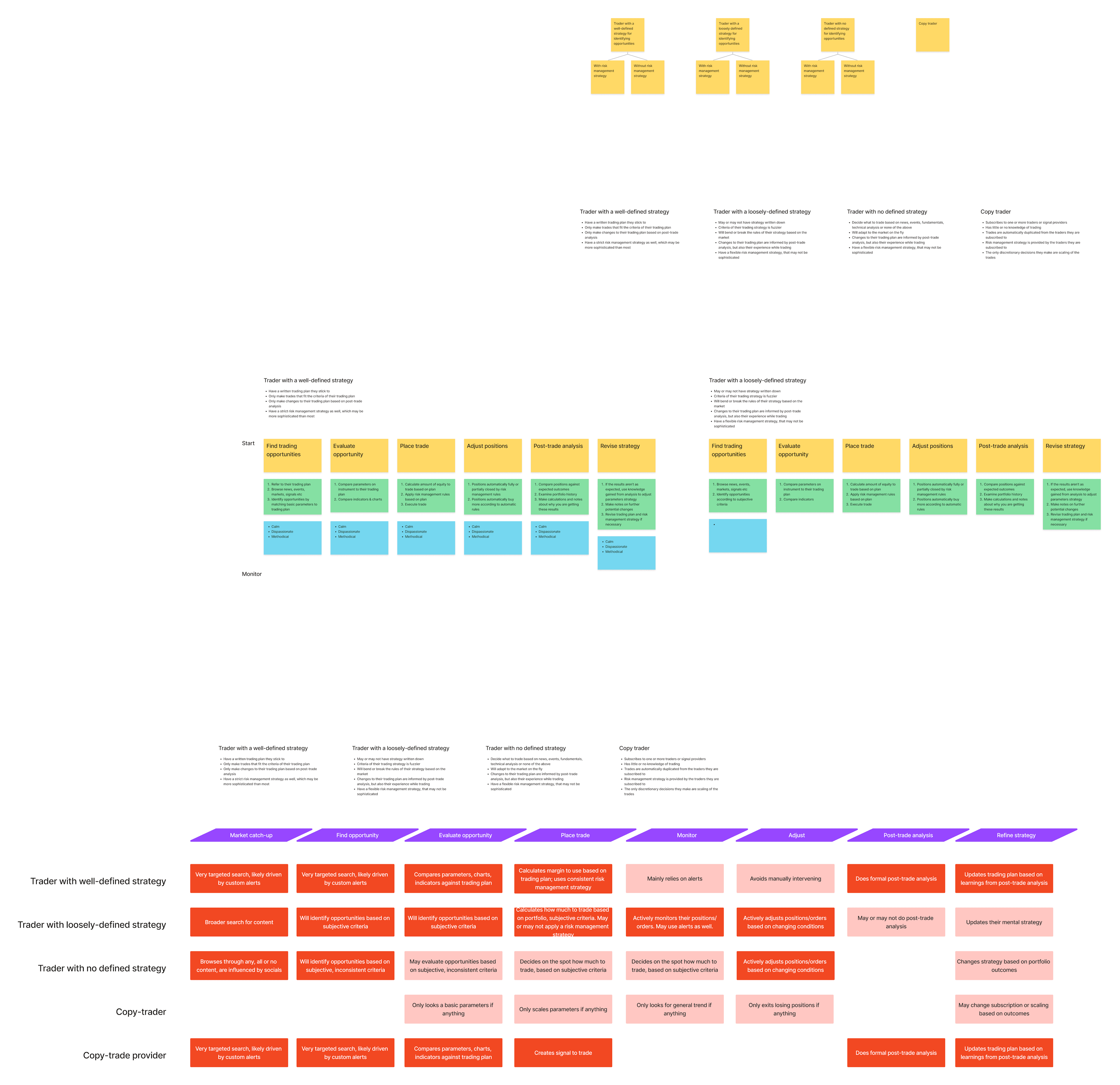

User Cohorts

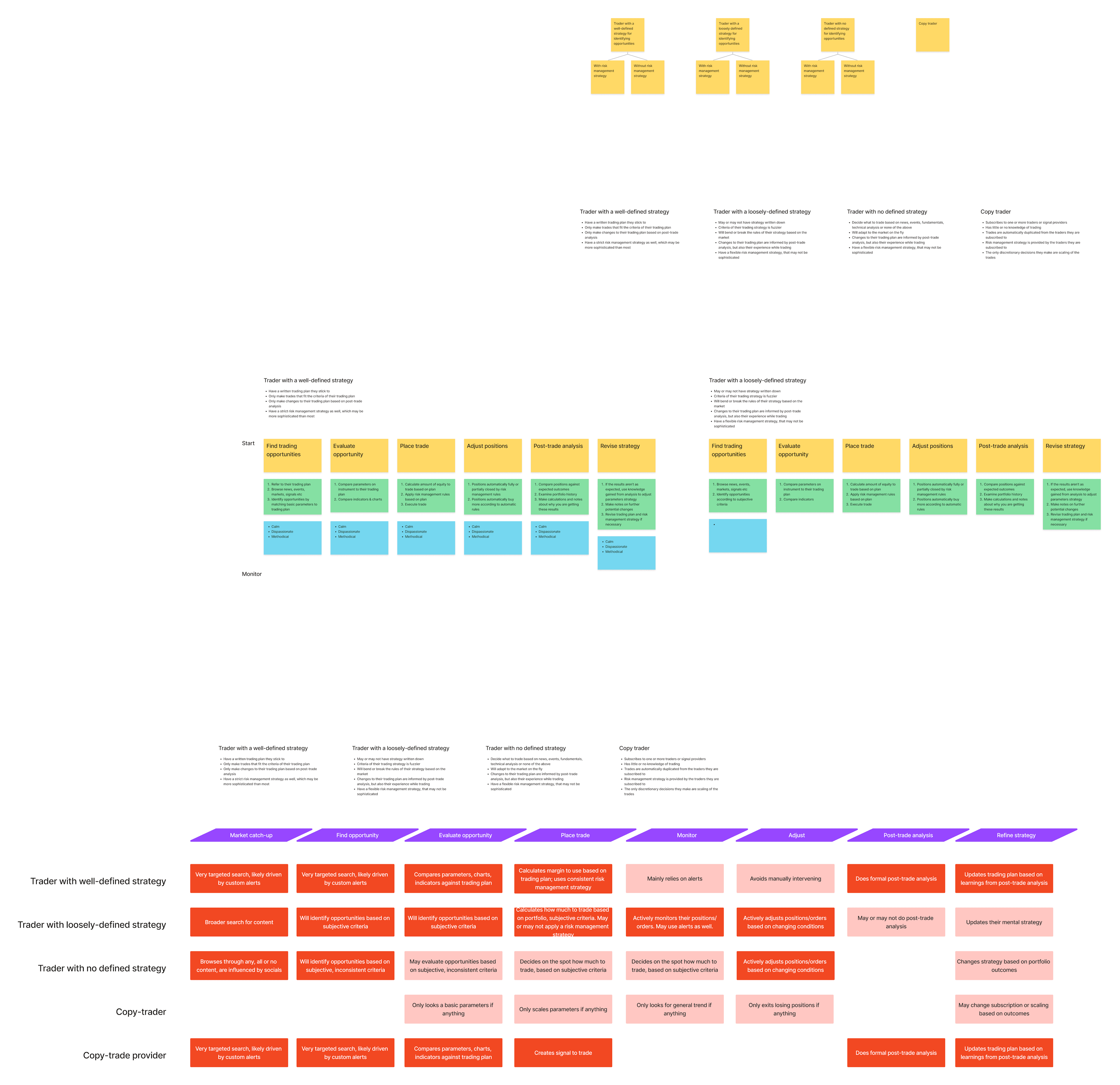

From my research and discussions I decided there were three primary cohorts of users relevant to automated trading:

- Traders with a well-defined strategy: they have a written trading plan that they stick to religiously, along with a strict risk management strategy. They only make changes to their trading plan derived from post-trade analysis.

- Traders with a loosely-defined strategy: they may or may not have a trading plan written down; the key thing is that they are flexible and apply their own rules (if any) subjectively. They may or may not do post-trade analysis and may not have a comprehensive risk management strategy.

- Copy traders: some automated trading tools allow you to automatically duplicate trades performed by other traders. These traders are not actively engaged and have no interest in improving their own trading ability.

Ideas

Based on what I had learned, I decided that full automation was far too risky, both for the individual trader and for the business.

I ultimately decided the three key pillars of my solution should be:

- Enable traders to be alerted when opportunities relevant to their strategies occur

- Enable traders to quickly and confidently make a discretionary trade from an opportunity

- Help traders to understand, formalise and refine their trading strategies

With that in mind, I came up with some broad ideas to explore, including:

- Discovery: Enable users to search for instruments to trade using complex queries which could be saved and reused later, with alerts, and projections past on past performance

- Algorithmic ordering: allow users to define complex criteria for when to buy or when to sell a specific instrument.

- Copy-trading: allow users to publish their trades, and other users to copy them

- Pre-defined expert advisors: provide a suite of expert advisors that traders can use rather than making their own

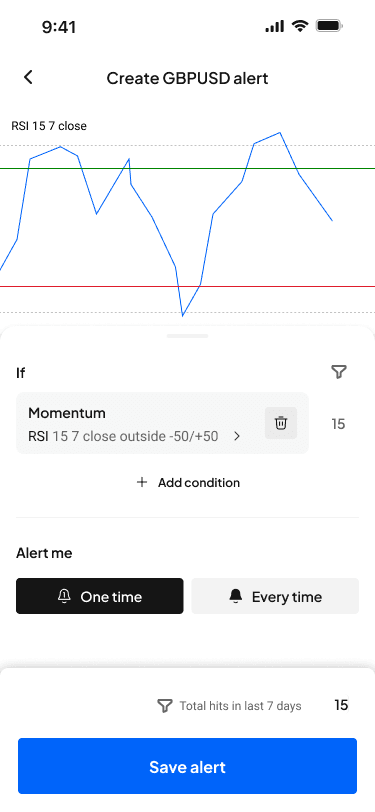

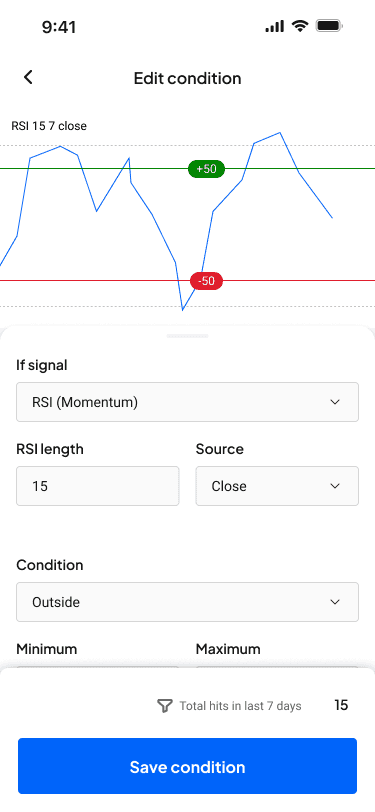

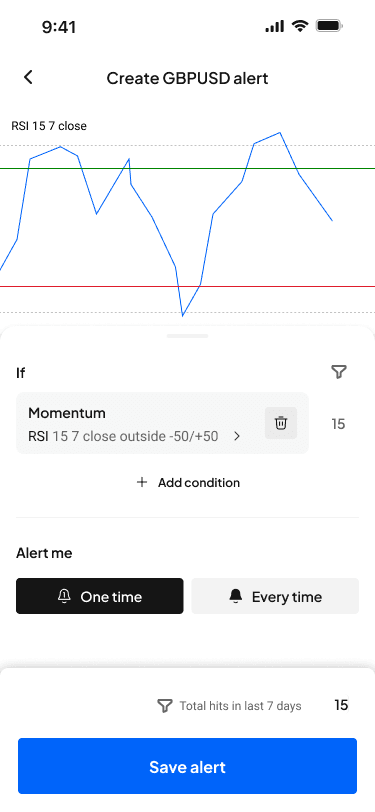

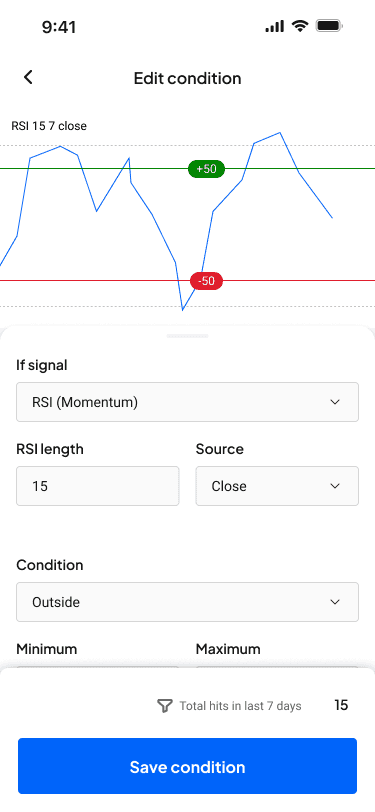

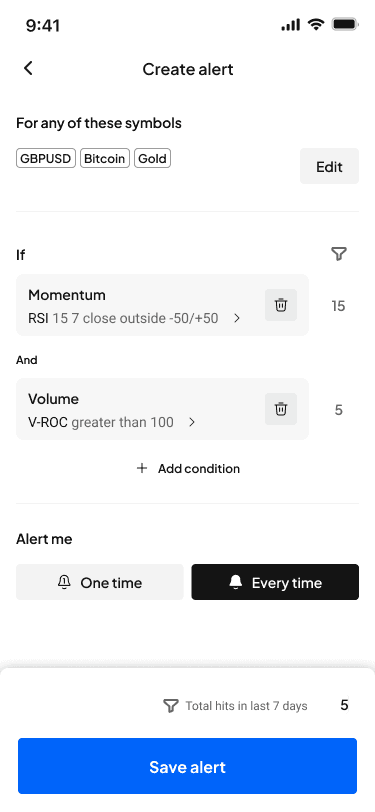

- Custom signals/alerts: allow users to define their own signals/alerts, providing their own criteria for which they will get alerted to potential opportunities to trade

Development

I chose to disregard copy-traders as a cohort from consideration as they are not engaged traders, not particularly interested in becoming better traders, and their use case isn’t really relevant to a mobile app (they are hands-off). Furthermore, copy-trading requires a community which would be hard to build.

I ultimately decided to go with a conservative solution of:

- Allowing the trader to define custom alerts they can then trade from

- Projecting potential trades and providing theoretical performance stats based on those user-defined alerts

Users could therefore start thinking strategically about trading and see what the outcomes would be on paper without any risk. Because of the relative simplicity, it wouldn’t require any programming ability, therefore eliminating a major barrier. Over time this solution would create a passive feedback loop, slowly encouraging them to become better traders.

I iterated on this concept, and tested wireframe flows of this concept with SMEs and stakeholders I previously canvassed, as well as other designers in my team. I used their feedback to further iterate and improve it.

Key design problems I had to overcome were:

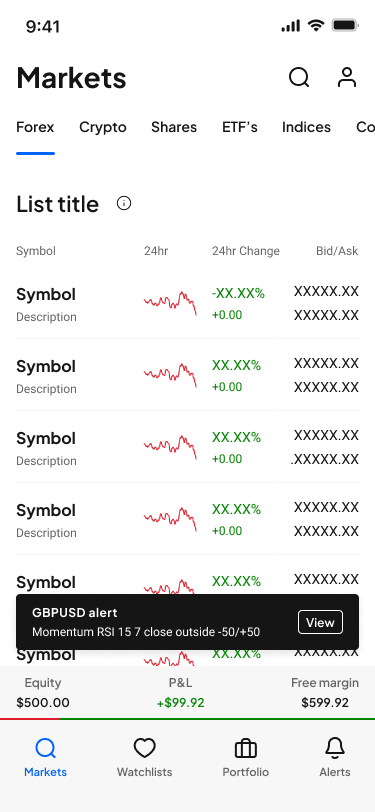

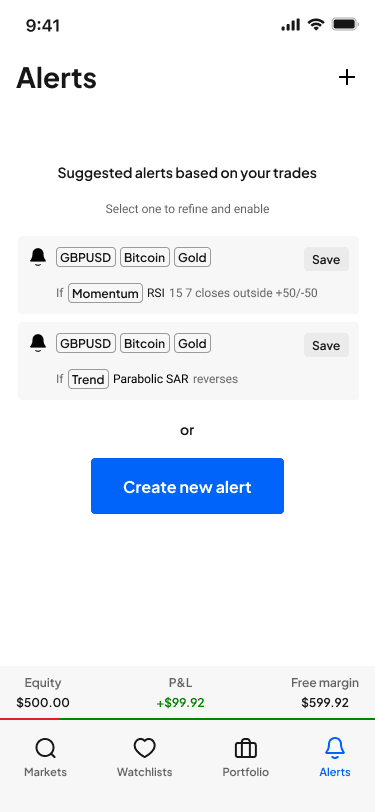

- Information architecture: as the lead designer initially intended for there to be some kind of section in the top-level navigation for managing any notifications, I extended that to manage custom user-defined alerts

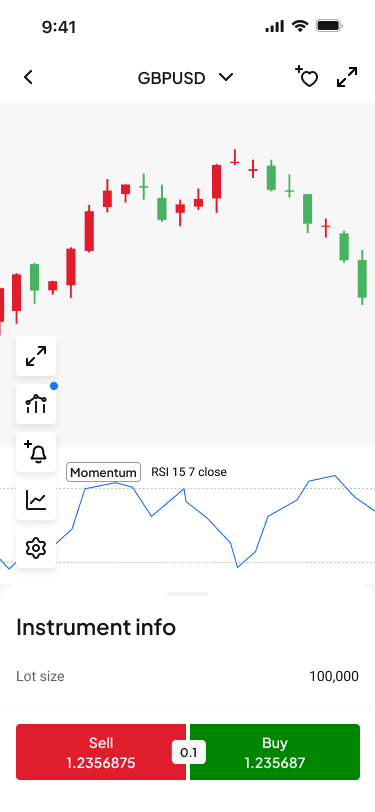

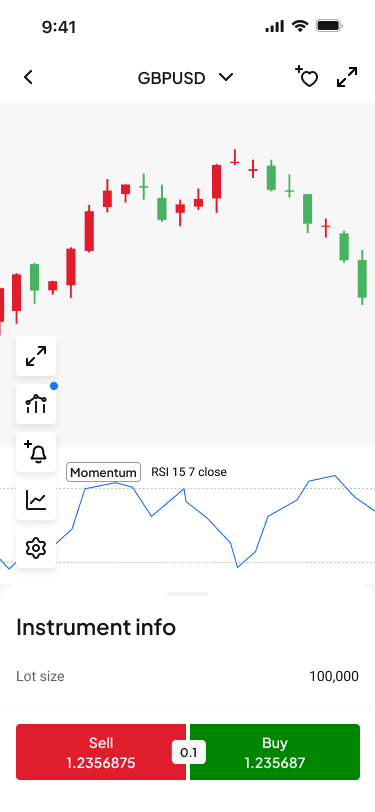

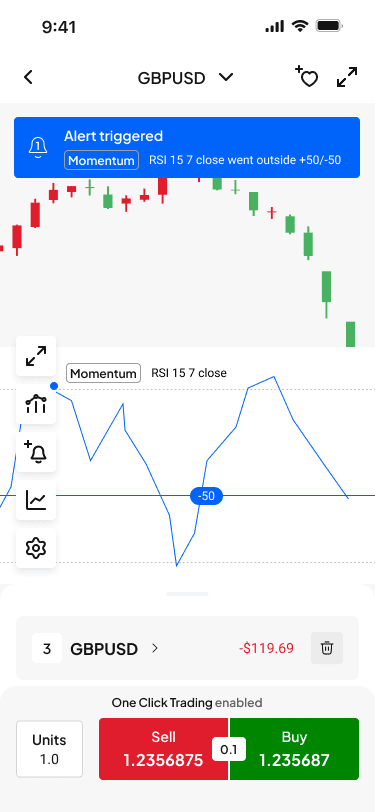

- User creation of alerts: Criteria for alerts would be based on price changes or indicator changes. These can be chosen by the user to be displayed on charts on the instrument screen, where they can also start a trade. As such, it made sense for the user to be able to create an alert and set the criteria on those charts from the same screen.

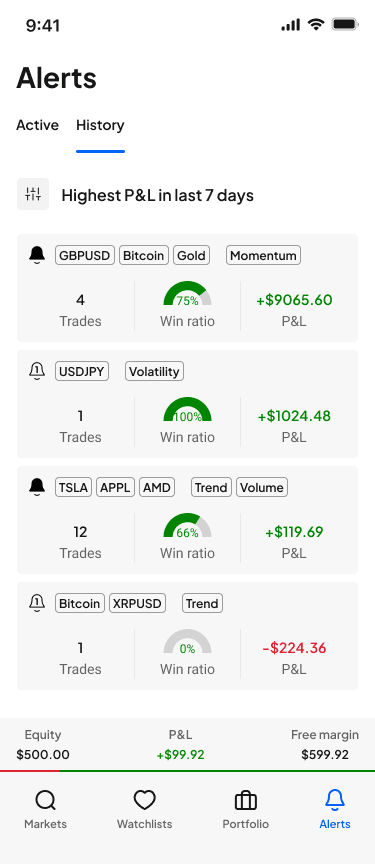

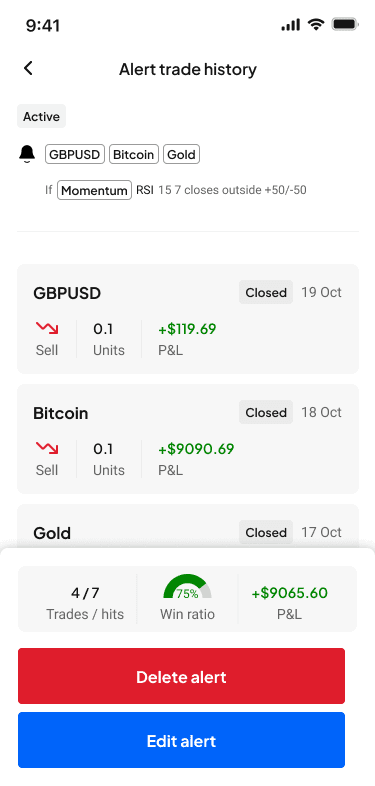

- Tracking performance of alerts: I chose three key stats for tracking the theoretical performance of each alert - number of trades, win ratio, and profit and loss - because these stats would make it easy for a user to understand performance over time. I provided visual indicators to make them easy to understand at a glance.

Solution

As a trader with a loosely defined strategy:

- When you view the details of an instrument with an eye to trade at some point in future, you can select and view different indicators that may affect your decision to trade

- You can choose to be alerted in future when conditions you choose are met

- When you receive such an alert you can jump to the instrument detail screen and quickly make a discretionary decision to trade or not

- At any time you can view active alert rules from a top-level alerts section in the app - from here you can see simple statistics that tell you how successful your historical trades are for each alert

- You can turn successful one-time alerts into recurring alerts and refine the conditions over time to increase the performance of the strategy

As a trader with a well-defined strategy:

- You can jump straight to the alerts section and define alerts for entire categories of instruments, so you can just trade off of alerts

- With performance statistics for the trades you make off the back of these alerts, you can reduce effort required in post-trade analysis

- You can directly compare the performance of different strategies (alerts), building confidence and certainty in your successes

- You can tweak and refine your strategies over time, adding and changing conditions as necessary to improve performance of the strategy or strategies

Next steps

Although further development was not possible within the given timeframe, the concept can be broken down into milestones which could potentially be implemented and released independently:

- One-time alerts and basic alert management: Test the effectiveness of this feature for all user cohorts and assess its usefulness. Feedback from the use of alerts would help prioritise further development. The workflow for creation of alerts should be subjected to through user testing to find any issues.

- Recurring alerts: Need to test how traders might use these and integrate them into their workflow.

- Alert performance history: Assess how traders might use this to inform decision-making.

Moderated user testing is recommended for each component to validate and refine the design with each cohort.